Union Pacific Corporation

Operating efficiency gains and aggressive repurchases have delivered attractive returns to shareholders over the past decade. Will these trends continue?

Introduction

Union Pacific is a Class I railroad that serves the western two-thirds of the United States over a 32,452 mile network. The company was founded in 1862 when President Lincoln signed the Pacific Railway Act which provided incentives to build the first transcontinental railroad. The railroad industry has been consolidating for decades. Today’s Union Pacific is the product of numerous mergers.

Serving ten thousand customers in twenty-three states, Union Pacific is a vital link to the global supply chain and offers connections to rail systems serving the eastern United States as well as Canada and Mexico. The company provides service to ports on the Gulf and Pacific coasts to facilitate import and export traffic. The railroad industry in the western United States is effectively a duopoly with Union Pacific and BNSF operating route networks that are very similar in size and scope.

Railroads face competition from long-distance trucking but rail is far more fuel efficient in terms of how much cargo can be carried per gallon of fuel. On average, Union Pacific transports 463 tons of freight on a gallon of diesel fuel which is three to four times more fuel efficient than trucks. Due to industry concentration, railroads are subject to political scrutiny and expected to provide reliable and cost-effective services for customers who have limited alternatives.

Over the past decade, Union Pacific and BNSF have both experienced relatively stagnant revenues. Although railroads compete with trucking for certain types of shipments, the reality is that rapid revenue growth (in real terms) is unlikely in this industry. In order to improve financial results, it has been necessary to operate more efficiently through restructuring of operating models and cost cutting.

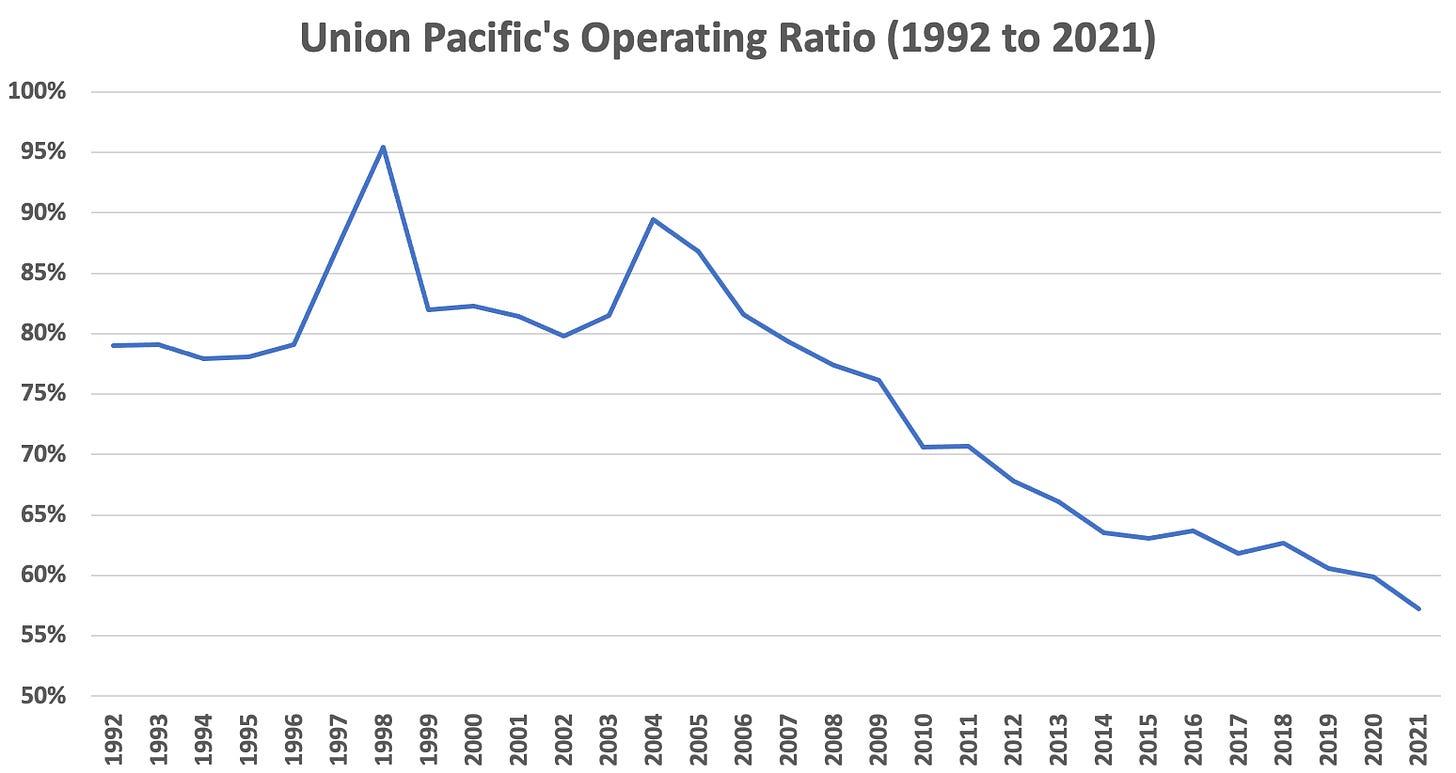

A railroad’s operating ratio is defined as operating expenses divided by operating revenue. The lower the operating ratio, the more profitable a railroad can be. The drive for efficiency has been underway for a long time and Union Pacific’s operating ratio has been on a downward trend since 2004.

Although Union Pacific’s revenue has barely increased over the past decade, it has become much more profitable. It is necessary to discuss Precision Scheduled Railroading (PSR) to understand how railroads have improved efficiency in recent years. Following an overview of PSR, we examine Union Pacific’s operating history and its balance sheet, cash flow generation, and capital allocation track record.

The rest of this profile of Union Pacific can be downloaded using the links below.

Copyright and Disclaimer

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

First time I read your reports and I must say this one on UPC is very thorough and well written. Perhaps one thing would be interesting to know what happened to the pricing power of the business given that it seems that overall volume went up, but revenues did not seem grow faster than volume. In other words is this a business that moves essentially with volumes? Anyway thank for publishing the "full monty" version of it. I appreciate. Best Stefano